Payroll & Finance

2021 April Payroll Changes

February 24, 2021

As usual, with the new financial year just around the corner there are a few upcoming payroll and tax changes that employers need to know about.

Minimum wage changes - April 2021

From 1 April 2021 the adult minimum wage will increase from $18.90 to $20.00.

The starting-out and training wages will increase from $15.12 to $16.00 per hour (80% of the adult minimum wage).

These changes are effective for any hours worked from 1 April 2021.

If you have employees on the minimum wage, starting-out wage or training wage, make sure you update their pay rate in your payroll system. If you’re using PayHero, it’s easy to change pay rates, even in the middle of a pay period. Check out the details here.

PayHero’s Minimum Wage Top Up feature will automatically factor in the minimum wage increase.

New tax threshold and tax codes

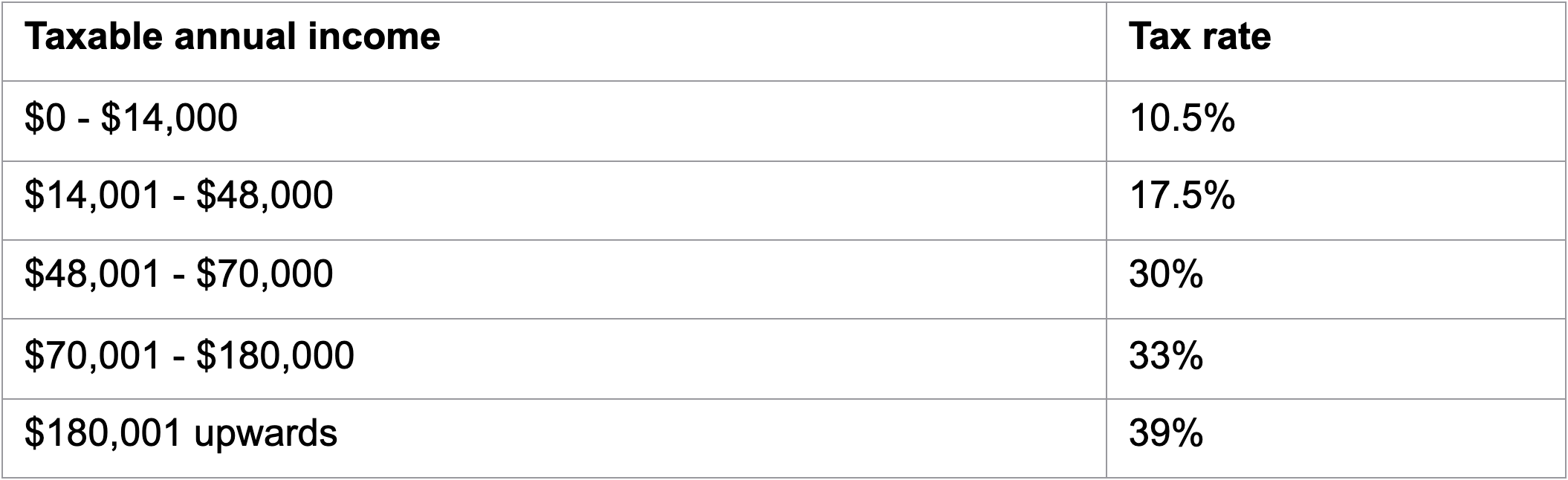

From 1 April 2021 a new tax rate will be applied to NZ’s top earners. This is the first change to the tax bands since 2010.

This increases the top tax rate for individuals to 39% for the 2021-22 tax year for annual income above $180,000.

The new income tax rates for individuals are:

PayHero takes care of this change automatically for you.

To support the new top marginal tax rate there are two new tax codes for those with secondary earnings over and above primary earnings of at least $180,000. SA and SA SL are used in this case. Because these secondary tax codes are for earnings above the ACC threshold (remaining unchanged this year at $130,911) the ACC Earner’s Levy does not apply to these. This means the existing ST and ST SL tax codes only apply for earnings between $70,001 and $180,000.

Other changes

A new Employer Superannuation Contribution Tax (ESCT) rate of 39% has been introduced for scenarios where earnings plus superannuation is more than $216,000. The existing 33% ESCT rate now applies where earnings plus superannuation is between $84,001 and $216,000. PayHero will automatically apply the correct ESCT rate for employees when you run the first pay for the new tax year.

The student loan repayment threshold is increasing from $385 to $390 per week. PayHero takes care of this automatically for you.

Payday Filing updates

A new version of payday filing makes some minor changes to the way additional compulsory and voluntary student loan payments and employee share schemes (ESS) are declared. Where it’s known, the hours worked by each employee can also be sent through. These changes are mostly behind the scenes and are designed to improve the data that Inland Revenue receives.

If you’re using PayHero and have an ESS, please contact support@payhero.co.nz so we can set it up for automated payday reporting.