Payroll & Finance

Leave in the Time of COVID-19

April 14, 2020

With over a million New Zealanders now being supported by the COVID-19 wage subsidy, it’s no surprise that our support team has been inundated with questions about the subsidy and related payments. As companies are getting accustomed to processing the payments, attention is shifting to the effect of the reduced payments on employees’ leave.

For many companies their employees are unable to work as normal during the lockdown and are being paid just the wage subsidy amount or, where possible, companies are topping up to the recommended 80%. But the amount paid isn’t related to actual work being done. This can have implications on annual leave balances and rates further down the track.

There are two fundamentally different ways in which NZ payroll systems handle annual leave that will determine the complexity of handling the wage subsidy payments:

Annual four week entitlement only

Accrue leave with each pay

Let’s take a closer look at each of those, and the complexities that arise from the wage subsidies and decreased earnings.

Annual four week entitlement only

The latest MBIE guidance recommends recording annual leave balances in weeks and discourages accruing leave with each pay:

“It is strongly advised that annual holidays balances are kept in weeks. This will reduce the risk of non-compliance. Keeping balances in units other than weeks can lead to non-compliance if work patterns change.” p.32

While the Holidays Act is not without its problems, there are big advantages to this approach when it comes to the wage subsidy payments.

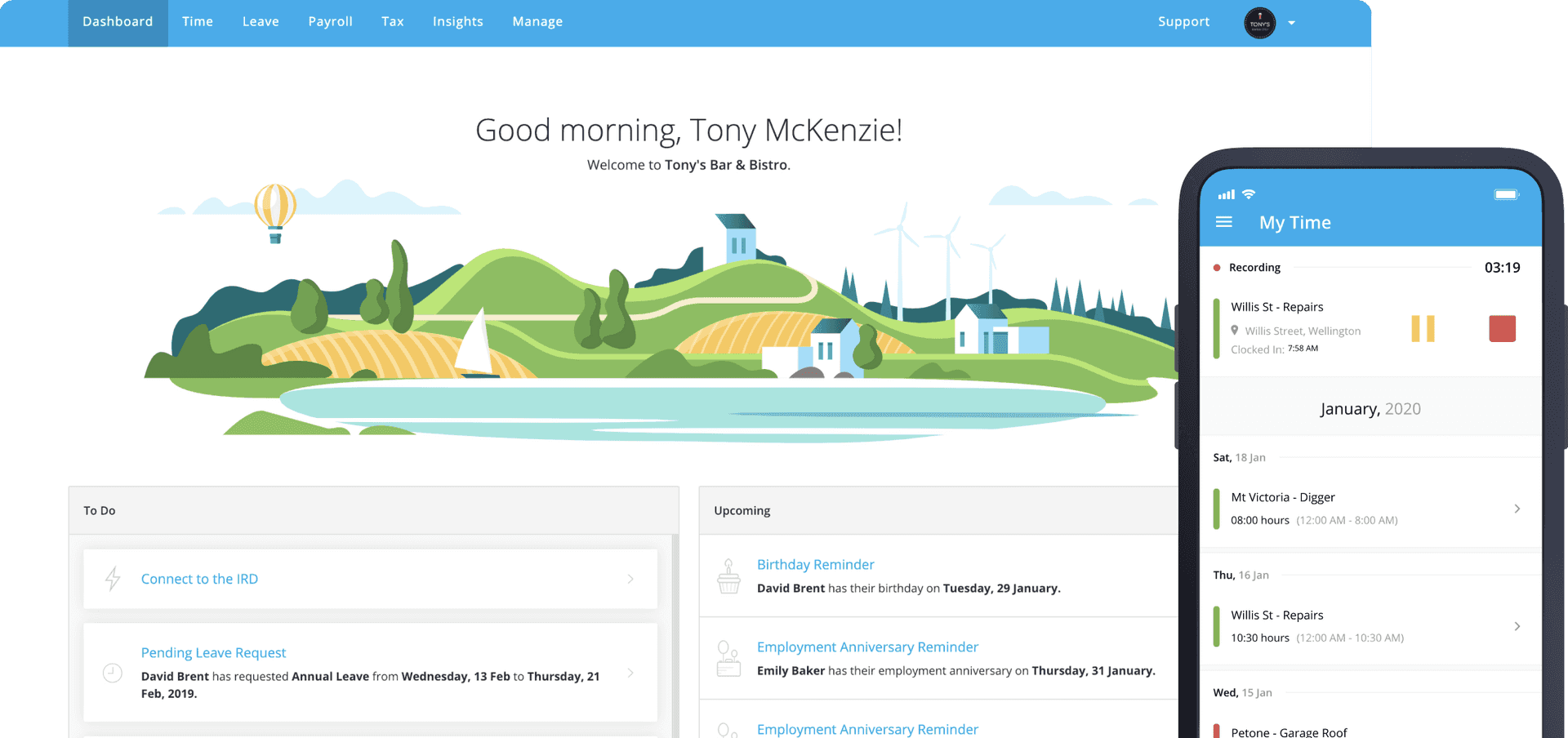

For payroll systems that follow this advice (such as PayHero), there’s nothing special that needs to be done. Pays are processed normally. Employees will still get four weeks leave when they cross their leave anniversaries. Ordinary and average weekly rates will naturally change as the employee’s earnings change. Simple!

Accrue leave with each pay

With this approach, throughout the year the employee has a bucket of “accrued” leave that gradually increases until they cross their leave anniversary when it is tipped into the tank of leave due.

This tends to be the way employees intuitively think of leave, because it has been a common approach in payroll software. It was so standard in the past that it was the approach detailed in the 2011 Holidays Act specification compiled by the NZ Payroll Practitioners Association in conjunction with the Dept of Labour.

Payroll systems using this approach tend to accrue leave in hours or days. But how many days/hours does the reduced earning represent? This results in two complexities.

How do you ensure that the employee will continue to accrue four weeks of leave? If their entitlement is reduced during the shutdown period, that doesn’t change the requirement in the Holidays Act that they get four weeks leave - calculated based on a typical week of work at the time the leave is taken. Companies accruing leave per pay run a high risk of non-compliance by reducing accruals during this period.

Let’s say your employees are being paid 80% - for 4 rather than 5 days - for the 12 weeks of the wage subsidy. Basing their accrual on the new days they will end up only accruing 19 days at their next leave anniversary rather than 20. When they are back working 5 days a week, they no longer have the requisite 4 weeks of leave.

Secondly, the days or hours in the pay may be used for future rate calculations. If a payslip has just a wage subsidy payment and there are no units associated with the pay, those earnings will increase leave rates. Conversely, if the full number of regular hours are used when an employee is earning a lesser amount, the ongoing rate calculations may disadvantage the employee.

Other Leave Types

While annual leave is considerably simpler with weeks based annual leave balances without ongoing accruals, both approaches may need a decision to be made on how many days a pay represents.

For employees paid an Average Daily Rate for other leave types (public holidays, sick leave, bereavement leave etc) every pay is going to need a number of days recorded against it. Where payments are reduced but the days remain the same, the average rate will of course be reduced.

COVID-19 and payroll

It’s clear from the wide range of questions our support team has been receiving that there is still a lot of uncertainty out there about the wage subsidy and other payroll implications of COVID-19.

We’re thinking of all of our customers during this difficult time and want to ensure you have the information you need to pay employees right. We’ve collected the information below and we’re constantly updating these resources as more information comes in.

Employment Law Q&A from Dundas Street Employment Lawyers:

If you have any other questions, or if there’s anything we can help with, please get in touch.

* OK, I’m trying to appear far more erudite than I really am with that title - it’s a literary reference that I just couldn’t resist. Sorry about that.