Payroll & Finance

Employer's Guide to Bonuses

February 16, 2022

Bonuses can be a win-win for employees and employers alike. Employees have the potential to earn some extra cash, while some research indicates that businesses with bonus schemes see higher productivity and increased talent attraction.

However, before you implement a bonus scheme in your business it’s important to understand the different types of bonuses and how they impact tax calculations, holiday pay accrual and annual leave rates.

In other words, the type of bonus you pay will determine how much cash in hand the employee ends up with, and the pay rates employees receive when taking leave.

Types of Bonuses

A bonus is an additional payment on top of base wages or salary. Bonuses are not compulsory for employers and are usually awarded to staff for good performance.

Some types of bonus payments in New Zealand include:

Regular Bonus: This is given to employees on a consistent or defined basis. These bonuses will be outlined in the employment agreement then paid when the employee or company hits certain performance criteria.

One Off Bonus: This is an infrequent bonus with no regular date. For example, a performance bonus triggered by an isolated achievement at random times during the year.

Discretionary Bonus: An employer has no obligation to pay discretionary bonuses and they will not have been detailed in any agreement with the employee. This can be a grey area; more on this later. A Christmas bonus is an example of a discretionary bonus.

How Bonuses Affect Holiday Pay Accrual + Annual Leave Rates

How much an employee gets paid when they take annual leave is dependent on their gross earnings.

The Holidays Act states gross earnings is not just made up of salary and wages, but also includes other payments including allowances, commission, leave and overtime. Gross earnings don’t include reimbursements, cashed out annual leave, redundancy or ACC payments not owed by the employer.

Regular bonuses are included in gross earnings, but discretionary bonuses aren’t. This is why each bonus has a different impact on annual leave rates and regular bonuses accrue holiday pay, while discretionary bonuses don’t.

How is this elusive holiday pay calculated?

When an employee is paid for Annual Leave Taken the rate will automatically be paid out at the highest of their Ordinary or Average Weekly Pay Per Day.

Ordinary Weekly Pay is what an employee would normally be paid. Where a component of their pay is a variable bonus, this is the average rate over the last four weeks.

Average Weekly Pay is based upon the total gross earnings over the past 12 months, divided by the number of weeks worked.

It’s important to realise that if an employee takes leave just after receiving a bonus their rate may be much higher than usual, because of how the bonus has affected the weekly rates.

You may be thinking, so which leave rates are affected by each bonus?

Regular Bonus: With a Regular Bonus paid out every four weeks or less, employees will accrue holiday pay on the bonus. Both the ordinary and average pay rates will increase.

With a less frequent regular bonus, for example a bonus paid quarterly, the employee will also accrue holiday pay on this bonus, however it will only increase the average pay rate, not the ordinary pay rate because it is based on gross earnings, not a weekly calculation.

One Off Bonus: This is handled the same as a less frequent regular bonus for leave rates and holiday pay.

Discretionary Bonus: Employers are under no obligation to provide this type of bonus and employees should not expect them. This means Discretionary Bonuses don’t accrue holiday pay and leave rates are unaffected.

How Bonuses Are Taxed

Regular Bonuses: For bonuses paid at the same time as regular pay, add the bonus to the pay period, and calculate PAYE as usual according to the employee’s tax code.

For monthly bonuses covering more than one pay period there are four steps to take:

Add up the gross wages paid for a month’s income

Work out the PAYE on these gross wages

Add the bonus to the gross wages calculated at step 1 and work out the PAYE for the month on the total.

Subtract the PAYE calculated at step 2 from that calculated at step 3. This gives you the PAYE on the bonus.

For bonuses covering more than one month (a less frequent bonus), there are also four steps:

Divide the bonus by the number of months it covers. This gives you the monthly bonus amount.

Add the monthly bonus to the normal pay for the month and calculate PAYE. Select monthly in the PAYE calculator.

Calculate the PAYE on the normal monthly pay and subtract this amount from the PAYE calculated at step 2 above. This gives you the PAYE on the monthly bonus.

Multiply this by the number of months the bonus covers to get the total PAYE to be deducted from the bonus.

For more information on these processes, check out the IRD Specification document.

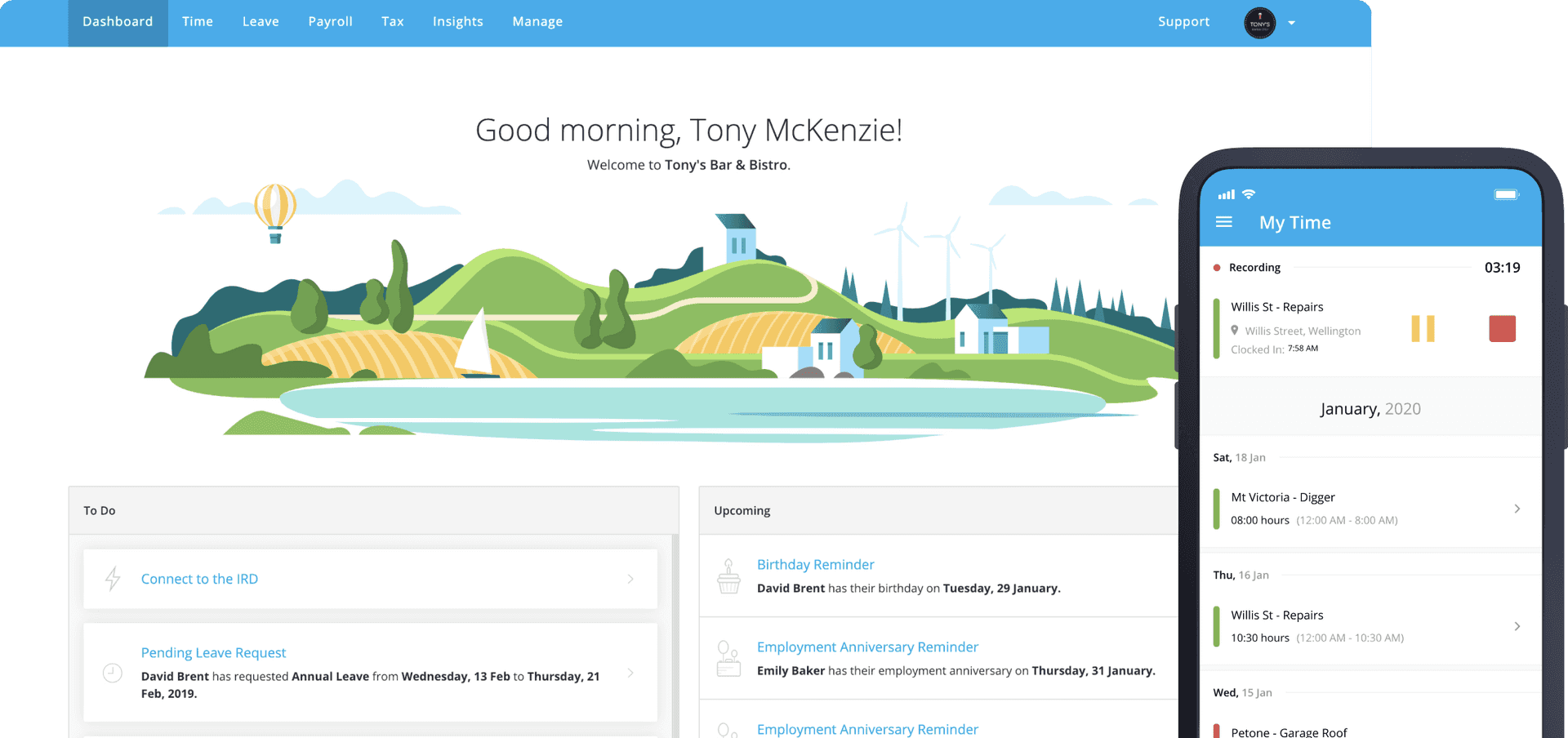

As you can see, sometimes it can get curly… but PayHero takes care of the complexity and can calculate PAYE for regular and less frequent bonuses.

It’s possible that regular bonuses may bump your employees into a higher tax bracket. If this is the case, it’s always good to have a conversation about this so employees know exactly what’s happening.

Discretionary and One Off Bonuses: Bonuses with no regular pattern to them are taxed as a lump sum (extra pay) payment. IRD has a helpful article about calculating lump sum payments, but here is the step by step process outlined by Business NZ:

Work out what your employee has earned (before PAYE) over the past four weeks.

Multiply this figure by 13.

Add the lump sum payment to the figure in step two.

Use this tax rates article to work out what income bracket your employee is in.

Deduct PAYE from the lump sum payment at the rate shown in the right-hand column for that income bracket.

Why does the lump sum rate seem so high?

It can appear to employees as if lump sum tax calculations disadvantage them since they will seem to be taxed at a high rate, at least when compared with the effective tax rate of their regular pay which incorporates the lower tax thresholds. In fact, this calculation is designed to reduce their tax.

If the bonus were just added to their other earnings and taxed with no special handling, the PAYE calculation would assume they always get paid far more than they do and could tax some of their earnings at a higher rate.

Essentially the regular pay calculation has used up all of the lower tax rate bands, so the extra pay must be taxed at their highest marginal rate.

Take an employee earning $1,000 per week ($52,000 per year) receiving a $1,000 discretionary bonus. Their regular earnings are distributed across the 10.5%, 17.5% and 30% tax bands, giving an effective tax rate of 18%. Adding the $1,000 on but not doing extra pay calculations means they reach the 33% tax bracket on assumed annual earnings of $104,000, so the effective tax rate is 25.7%. Correctly applying the extra pay calculation means the extra $1,000 will all be taxed at 30%, giving an effective tax rate of 24%.

What about commission?

Commission is handled the same way as a regular or less frequent bonus for tax and holiday pay rate purposes. Commissions will be considered gross earnings if they are paid as part of an employee’s regular pay.

Here’s a table to summarise how tax calculations and holiday rates work together:

| Regular Tax Calculation | Bonus Tax Calculation | Extra Pay (Lump Sum) Tax Calculation |

|---|---|---|---|

Accrues Holiday Pay, Increases Ordinary and Average Rate | Ordinary earnings Bonus and commission regularly paid with ordinary earnings. | Bonus or commission paid 4 weekly when employee is paid weekly or fortnightly | Uncommon |

Accrues Holiday Pay, Increases Average Rate but NOT Ordinary Rate | Uncommon | Any regular bonus or commission paid less frequently than monthly e.g. quarterly. Monthly bonus or commission paid to someone on a less than monthly pay cycle. | Infrequent bonus with no regular date, e.g. performance bonus triggered by achievement |

No Holiday Pay, does not impact Average or Ordinary Rates | Uncommon | Uncommon | Discretionary bonuses, e.g. Christmas bonus Employee share scheme |

The Importance (and difficulty) of Getting It Right

It’s not always clear cut how individual bonus schemes should be treated in payroll and recent case law has shown how complex it can be.

A recent high profile court case involved a glass company that implemented a short term incentive bonus scheme they deemed discretionary. They were challenged by the Labour inspector who said these payments should be a part of gross earnings, increasing holiday pay rates. Long story short, the court initially determined that the bonus payments in question should be considered as gross earnings, but on appeal eventually concluded they were discretionary payments. You can read more about the case here.

Despite the difficulty in this area of payroll, it’s important to do your due diligence so employees are paid right. The type of bonus and how it will be awarded should be clearly outlined in writing, ideally in the employee agreement. If in doubt, seek advice from an employment lawyer.

The Holidays Act Review currently underway will likely remove any special handling for discretionary bonuses, meaning all bonuses will accrue 8% holiday pay.

Processing Bonuses In Payroll

Once the type of bonus payment is confirmed, employers must ensure they’re processing bonuses correctly in their payroll system, otherwise employees may be paid less holiday leave than they are entitled to or taxed incorrectly.

Most payroll systems should have the functionality to include bonuses in the appropriate pay cycle rather than having to run a one-off pay. In PayHero, bonuses can be set up using Pay Items, then directly added into an employee's pay. The frequency can also be adjusted in PayHero to ensure the bonus is being taxed correctly according to what type it is. Alternatively, bonuses and taxes can be adjusted manually, but this requires far more effort.

Bonus Tips for Employers

Clarify the frequency of the bonus, then choose the appropriate type

Ensure your payroll system is set up to correctly comply with New Zealand tax and holiday law

Add any bonus plans into the employment agreement

Communicate to employees how, why and when bonuses are awarded

Be careful with discretionary bonuses, ensuring there is no expectation of them being paid

If you’re able to consider bonuses they are always a great way to thank employees for their hard work. Our PayHero payroll system can help automate this process to ensure everybody benefits. Read more about PayHero here.