Payroll & Finance

Payroll Guide to KiwiSaver

July 26, 2022

KiwiSaver is a government initiative designed to help employees invest in their futures, and it’s important that employers get it right when it comes to payday. We’ve pulled together this Payroll Guide to KiwiSaver to talk through everything you need to know about how the KiwiSaver scheme interacts with payroll processing.

What is KiwiSaver?

KiwiSaver is a voluntary savings scheme to help Kiwis achieve long-term saving goals for their retirement or first home. Once employed, workers aged between 18-64 will be automatically enrolled into KiwiSaver and will see deductions being made on their payslips.

After two weeks of contributions in a new job, employees have the option to opt-out up until their eighth week of work, at which point the contributions become permanent. Only employees that automatically enrolled have the option to opt-out.

Both employees and employers must contribute to KiwiSaver schemes if the employee is eligible. The default contribution rate is 3% but employees have the option to contribute more of their pay at 4%, 6%, 8% or 10%. As the employer, you are obliged to contribute at least 3% of the employee’s gross earnings. Employer contributions can be at a higher rate if specified in the employment agreement.

Who is eligible to make KiwiSaver contributions?

To make contributions, employees must be living in New Zealand and hold either New Zealand citizenship, a visa that entitles them to reside in New Zealand indefinitely or be an Australian citizen. Employees cannot join if they are Kiwi citizens only in New Zealand temporarily, or if they hold a temporary, visitor or student visa.

Employees under the age of 18 will need to join KiwiSaver through their scheme provider of choice, and then IRD will notify the employer so the contribution can take place. Employees aged 65 and over can take part in KiwiSaver, but the employer is under no obligation to contribute.

Alternatively, if casual or temporary employees are employed for 28 continuous days or less, they can still join, but won’t be automatically enrolled.

KiwiSaver obligations for employers

When it comes to KiwiSaver, you have several responsibilities as an employer. These obligations include;

Ensuring all eligible new employees are enrolled in KiwiSaver

Providing all new and existing employees with KiwiSaver information packs

Deducting KiwiSaver contributions from employees’ pay

Make compulsory employer contributions and pay tax on them via ESCT

Report both employer and employee contributions to Inland Revenue

Take action on employee opt-outs, saving suspension requests, and deduction rate change requests

KiwiSaver through Salary Sacrifice

Employers may choose to include their 3% KiwiSaver contribution in an employee's gross salary or wages to ensure everyone is paid equally, regardless of whether they are a member of KiwiSaver.

The deduction from the employer contribution is referred to as “Salary Sacrifice” and is included in the employee’s fixed remuneration, as outlined in the employee agreement. Both parties must discuss and agree to this arrangement prior to signing the employee agreement. It’s also important to note that the employer cannot pay the employee less than minimum wage after the deduction.

1.5% of employees paid through PayHero have Salary Sacrifice / Total Remuneration set up. In PayHero, you can add a Salary Sacrifice/Total Remuneration to an employee’s Default pay to ensure the 3% employer contribution is deducted from their earnings. Holiday Pay will then be calculated on every employee’s full total remuneration package, including the KiwiSaver amount. This is not the case in the default KiwiSaver approach.

How to manage KiwiSaver for your business

As outlined on the Business NZ website, there are a few different questions to ask and scenarios to consider when setting up KiwiSaver for your employees.

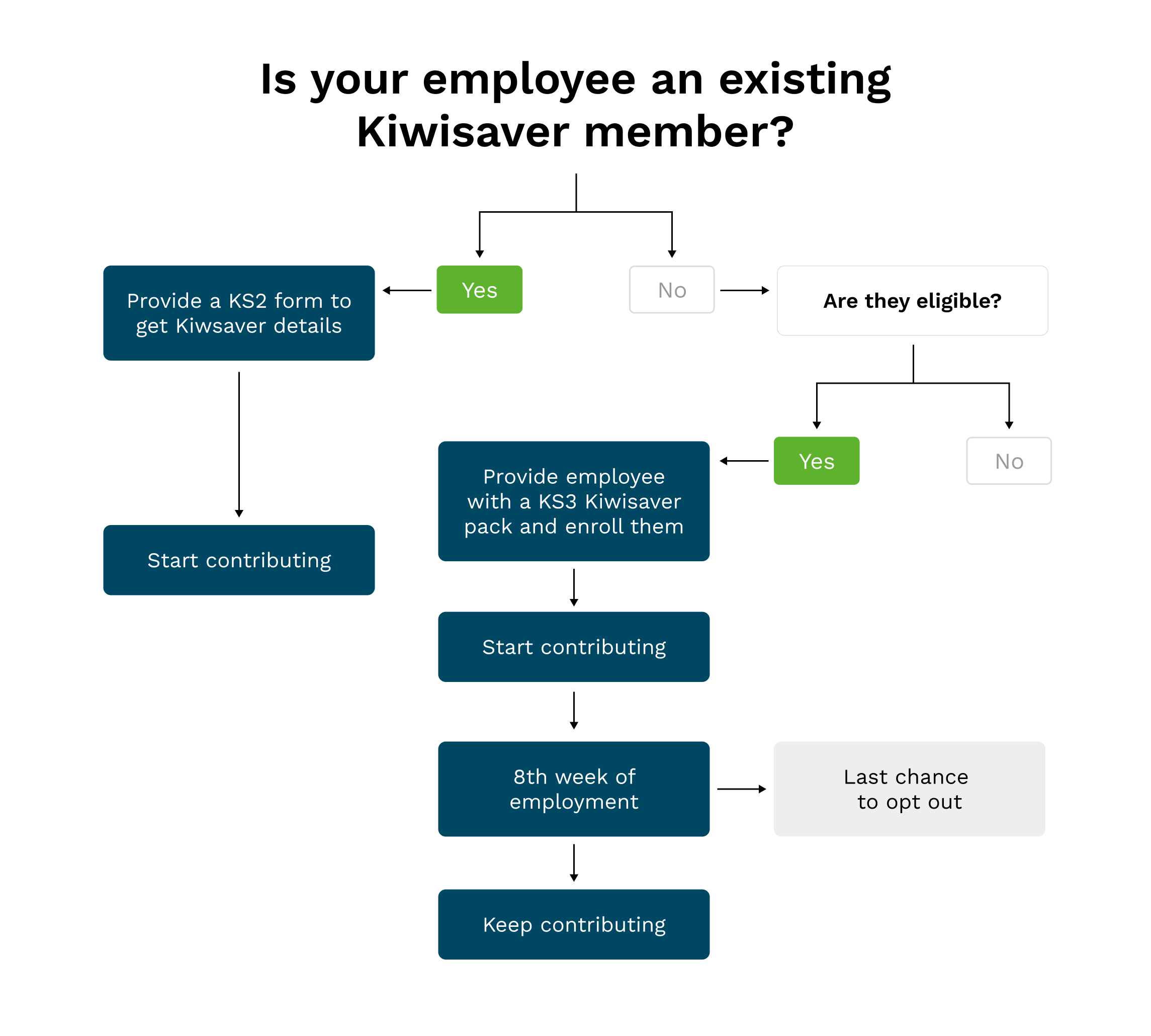

1. Review the employee’s KiwiSaver member status

Employees already enrolled in KiwiSaver must either give you a completed KS2 form (if unfilled you will automatically deduct the default rate at 3%) or a letter from Inland Revenue confirming they are on a contributions holiday.

or

For employees not already enrolled in KiwiSaver, enrollment is automatic for employees aged 18-64, with the option to opt-out in the first eight weeks of a new role. If the employee's age is outside of this bracket but they still want to contribute, they can still join by filling out a KS2 form or contacting a KiwiSaver provider.

In very few cases, some workers may be exempt from contributing towards KiwiSaver. When in doubt, contact IRD and read more on their website.

2. Enrol any relevant employees into KiwiSaver

For employees who are not already enrolled in KiwiSaver, you will need to give them a KS3 KiwiSaver information pack within the first seven days of employment. This includes the KiwiSaver Deduction Form (KS2). If you have an employer-chosen KiwiSaver scheme, give the product disclosure for the scheme and advise they will be placed in this scheme if they have no preference. You can let your employee know they are able to opt-out, but this must be done within the first 8 weeks of their employment.

Employees who are already KiwiSaver members are not required to be automatically enrolled. They just need to provide you with a filled out KiwiSaver Deduction Form (KS2) indicating their contribution rate, if they don’t do this they will contribute at the default rate of 3%.

3. Make KiwiSaver deductions in payroll

Now for the fun part. It’s time to calculate and deduct KiwiSaver contributions from employees wages and pay them to Inland Revenue, and send new employee’s KiwiSaver details to IRD. You will need to pay tax on all your employer contributions in addition to the PAYE deductions. This goes towards the employer superannuation contribution tax (ESCT).

Keep a digital or physical copy of these records as well as your employee’s KiwiSaver membership status, individual contribution rates and opt-out forms for those not in the scheme. For more details on this process and its calculations check out Inland Revenue.

If you use payroll software like PayHero the employee’s and employer’s KiwiSaver details will be automatically sent to Inland Revenue during payday filing. Just connect your PayHero account to Inland Revenue through myIR and there’s no extra work with your pay run. Inland Revenue will then forward this information to the employee's KiwiSaver provider.

How to manage KiwiSaver in PayHero

Within the employee section in your PayHero account, you can set up an employee’s KiwiSaver details on the Employment tab. This section is also where you can update KiwiSaver settings for your existing employees’.

To set them up correctly you will need to know whether they are already a KiwiSaver member. Their answer will affect what information you need from employees to set them up.

If they are a member, you will need to know:

The employee deduction rate

Employer contribution rate

Whether they are taking a savings suspension

If they’re not a member, you will need all the above and the additional information:

Their KiwiSaver enrolment date

The KiwiSaver opt-out date (if they choose to do so)

If you are setting up an existing employee in PayHero who isn’t eligible to contribute to KiwiSaver you can leave all fields blank.

All employees who are enrolled in KiwiSaver in PayHero will have the Employee Contribution and Employer Contribution added to their Default Pay, and these details will automatically flow through to their payslip.

If you need to edit an employee's KiwiSaver details, you can do so under the same tab. You may need to do this if an employee requests to change their contribution rate (by a letter or completing a new KiwiSaver deduction form - KS2) or if they wish to take a Savings Suspension.

For more on setting employees up in KiwiSaver, you can read our support article. Or if you’d like to read about setting up a salary sacrifice or total remuneration in PayHero read this guide.