Payroll & Finance

The Definitive Guide to Payroll Giving

November 14, 2023

Kiwis are a generous bunch, and the government likes to reward this giving. Inland Revenue figures show 354,200 people claimed donation tax credits in the latest financial year.

Individuals can claim a 33.33% tax credit for all donations over $5 to an Inland Revenue approved donee. For example, if you donate $100 to a registered charity, you can claim back $33.33, essentially meaning the taxman covers the remaining $33.33 to your chosen charity! Popular crowdfunding websites, like Givealittle, will show if pages are approved for the credit.

Typically, it’s a bit of a process to claim your tax credit – you have to complete an IR526 (a Tax Credit Claim Form) and send it to Inland Revenue with your donation receipt(s) and then wait for them to process the credit.

Thankfully, there’s a better way - payroll giving!

What is Payroll Giving?

Payroll Giving is a scheme where employers can allow their staff to donate to charities directly through their payroll system. It’s a seamless way for employees to give back to their chosen charity while automatically redeeming their tax credit in the process. Here are a few more benefits:

It simplifies the process of donating to charities and claiming the tax credit

It shows good corporate citizenship, which is important for the long-term well-being of your company and your employer brand

Employees want it! It’s always a good thing to offer initiatives that lead to loyal and supportive staff and lower turnover

It’s a low-cost, easily administered way of encouraging charitability within the community

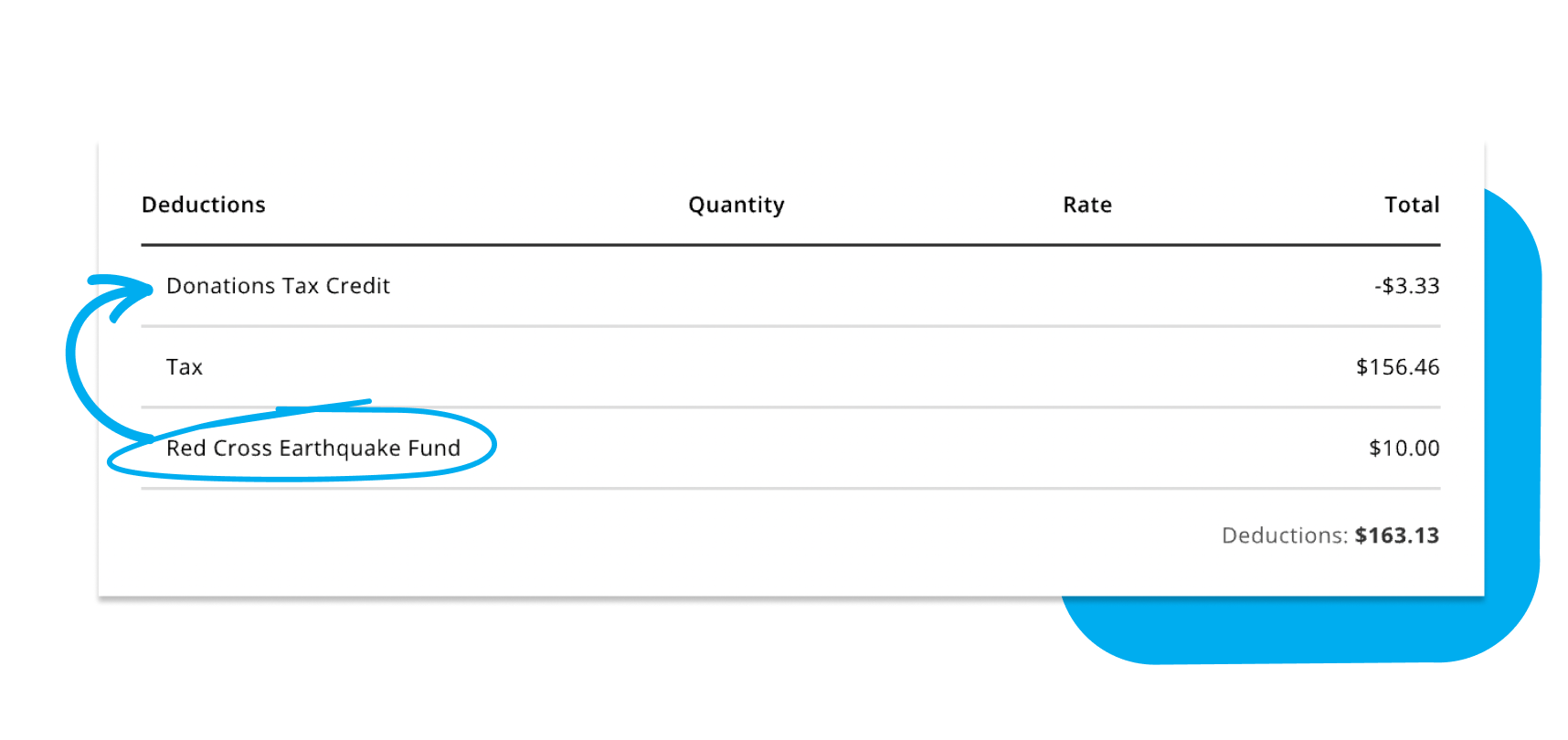

So, how does it work? The money is donated directly from an employee’s pay and they receive an immediate tax credit (33.33% of the donation amount) that reduces the amount of PAYE deducted from their pay.

Your employees’ responsibilities when joining payroll giving

If your employees want to join your payroll giving scheme, they need to check the donee organisation they want to donate to is an approved donee organisation and provide these details:

name of the donee organisation

donation amount they want to make

pay period(s) they want the donation to be made, and

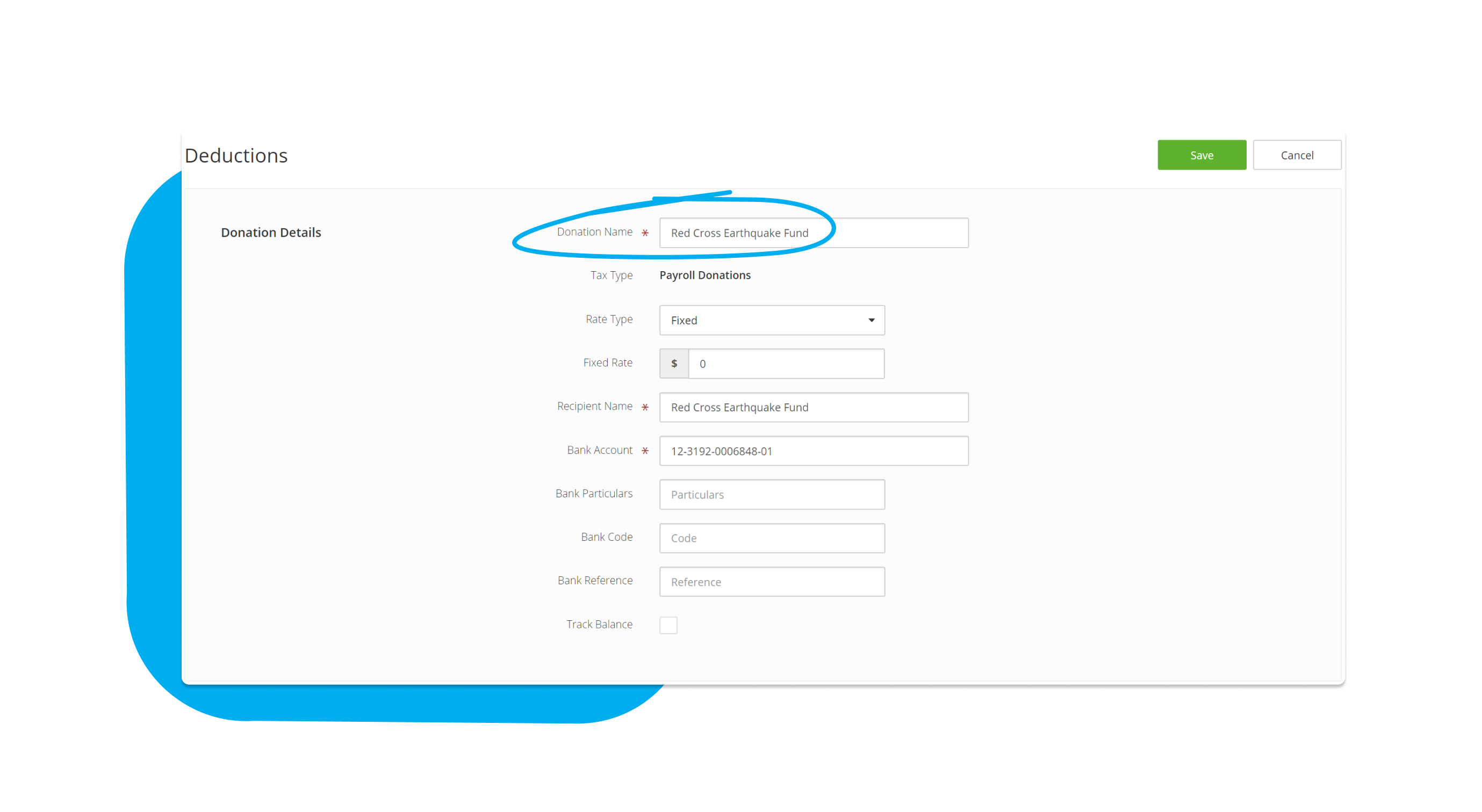

donee organisation’s bank account details or postal address.

The employee can ask to change the frequency, amount and donee organisation, as long as it meets your scheme requirements. For example, your scheme might state each donation needs to be a minimum of $10.

How to set up payroll giving as an employer

As an employer, you do have a few key responsibilities when you offer payroll giving:

Deduct the chosen donation amount from the employee’s earnings

Apply the appropriate tax credit for the donation (which is 33.33% of the donation)

Record this tax credit on your payday filing employment information schedule

Send the donation to the employee’s organisation of choice within a specified timeframe

Advise the chosen organisation that the donation is from payroll giving, and

Keep records of all the donation amounts, tax credit for each donation, payment dates and the chosen donee organisations

Most payroll systems can automate this process for you with a Deduction to be included in your employee’s pay cycle.

Bonus use case – Claim a tax credit on your school donations

It’s helpful to know that employees can claim a tax rebate on school donations through payroll giving as well. To qualify for this benefit you have to:

Have earned taxable income

Resided in NZ at any time of the recording tax year

Be an individual (not a partnership or company for tax purposes)

Have paid donations to a state or state-integrated school or kindergarten registered as a charity

Looking for more? Inland Revenue has an extensive guide.

And if you’re a PayHero customer, it’s easy to get set up today. Happy giving!