Payroll & Finance

Payroll Guide for Waged Employees - Paying Employees Who Work Variable Hours

May 17, 2022

Managing payroll for your salaried employees is usually a straightforward process, but the situation starts to get more complex when employees are paid an hourly wage. Some industries such as trades and agriculture aren’t as complicated because their employees tend to work more standard hours. However, in industries like hospitality, horticulture and tourism, leave calculations can get tricky as employees often work variable hours with no set pattern.

The following guide will clarify key payroll issues for hourly employees in New Zealand. Here, you’ll find everything you need to know about:

How to calculate leave for variable hour employees

Streamlining leave entitlements with time tracking

Domestic Violence, Bereavement, Alternative, Public Holidays, Sick (DBAPS) leave entitlements for your waged employees

General tips to help manage your team

Deciphering leave for variable hour employees

Calculating leave entitlements can be challenging if you hire hourly employees who work at variable times with no work pattern. So, what do you need to know to help calculate leave for these employees?

Holiday Pay As You Go and Gross Earnings

At any particular time, an employee is owed two separate amounts - Holiday Pay Due and Current Leave Due. Holiday Pay Due is typically 8% of gross earnings since the employee's last anniversary and is paid out when the employee leaves. Current Leave Due is their four weeks per year annual leave entitlement, and any remaining Current Leave Due is also paid out when the employee leaves

Now, this is all well and good for salaried employees, but for many hourly employees, this arrangement doesn’t work because they may work irregular hours or are on a fixed contract of fewer than 12 months. In this case, employees might receive Holiday Pay As you Go if specified in the employee agreement. However, if the employee doesn’t meet the requirements of HPAYG, they are paid out when they take annual leave.

If your payroll system doesn’t have an HPAYG setting, it can be calculated at 8% of gross earnings. You can view MBIE’s HPAYG criteria here.

With leave, gross earnings refer to all payments an employee receives during the assessed period.

Otherwise Working Days

An Otherwise Working Day is defined as a day an employee would normally work if the day had not been a public holiday, sick leave, bereavement leave, annual holiday or alternative holiday for that employee.

For variable hour employees with no set work pattern, it can be a challenge to determine which days qualify as OWDs, but it’s important to clarify this as it dictates what they get paid and when.

Several factors can be considered when determining OWDs, including the employee’s contract or employment agreement, the employee’s current work pattern, whether the employee only works when work is available and if there are reasonable expectations that the employee would work that day.

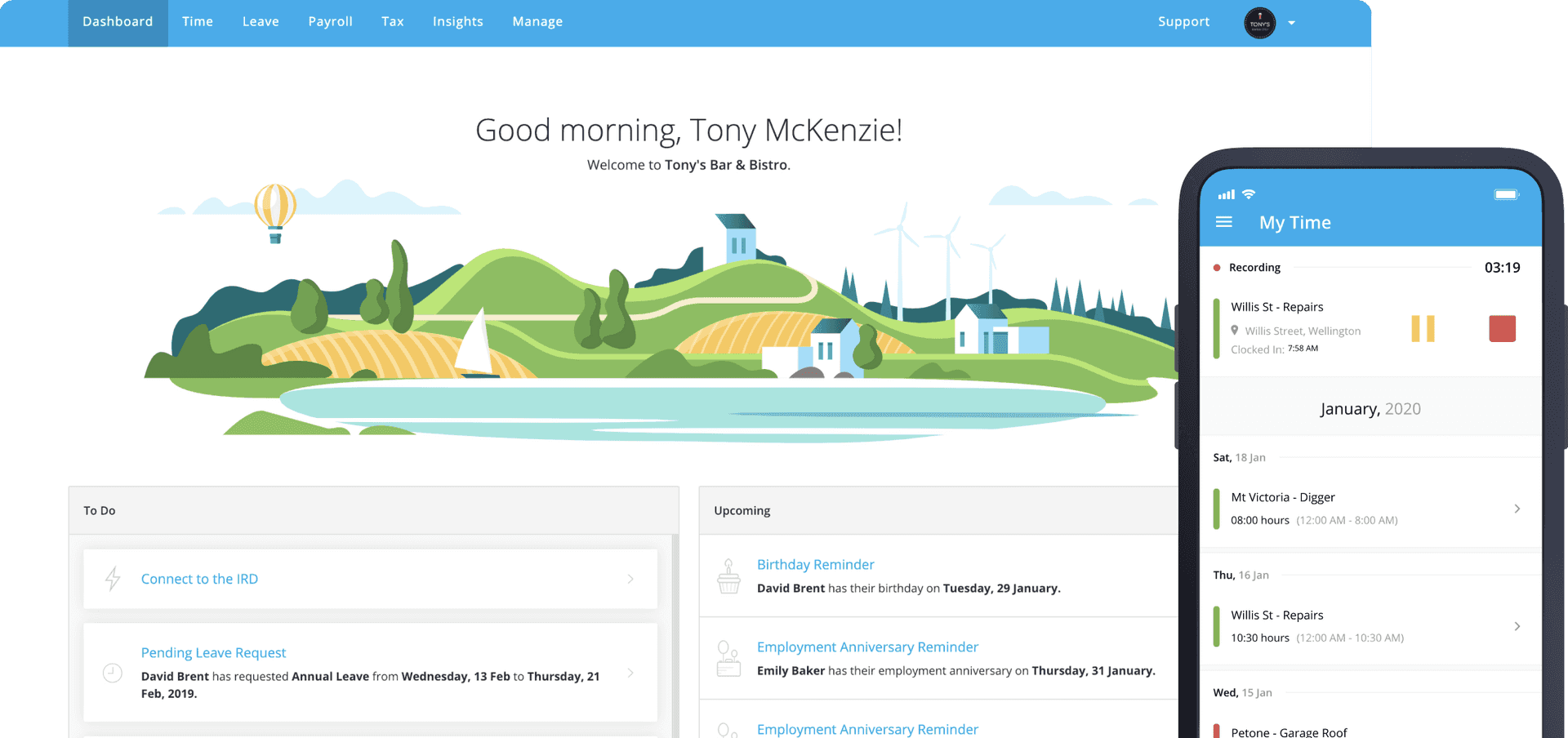

OWDs can be incredibly challenging. Thankfully, a great payroll system can help neaten out the quirks by looking at work patterns and timesheet data. For employees with no determinable pattern, PayHero will use your company review period and the employee’s recent time entries to determine OWDs. Of course, every employee situation is different, so it's important to check the details mentioned above if payroll returns a result you weren't anticipating.

Constantly changing work patterns

For part-time or hourly employees, leave entitlements should be determined at the time an employee takes leave to stay compliant with changing work patterns.

If your variable hour employees do not have a consistent or agreed on work pattern, payroll can use a review period to determine what a 'week' of leave looks like. This ensures when the employee takes leave, the review period will be used to calculate what portion of the annual holiday entitlement is being taken.

The Holidays Act suggests setting the review period to a minimum of 4 weeks. In PayHero, the default work pattern is set to a review period of 8 weeks and an Otherwise Working day minimum of 5 weeks. We’ve chosen to make the review period longer to make it fairer for employees and easier to calculate. This means if Johnny works 4 out of the last 8 Mondays, the Monday public holiday will not be an OWD for him. However, if he works 6 out of the last Mondays, it will be.

The Importance of Time

For variable-hour employees, time tracking makes all the difference

Businesses with hourly employees don’t always need to roster their staff because they work standard hours. However, time tracking is very important for employees who work variable hours... Without a full record of the hours and days worked, it’s hard to calculate leave entitlements. This is where a good timesheeting system saves the day.

Thankfully, complex excel spreadsheets are now (largely) a thing of the past. Removing any manual or paper-based processes ensures your employee information and timesheets are all in one place. Plus, many systems allow hourly employees to record their own time and access past timesheets.

If you’re concerned about keeping up with constant leave requests and unavailability, it’s also possible to integrate scheduling software and payroll so they can work together.

Don’t Forget the Breaks

Recording breaks is a vital part of nailing your time tracking so employees are paid right. Not to mention, breaks are a key part of promoting a good working environment, while preventing fatigue.

Revisions to the Employment Relations Amendment Act 2018 say employees must have set paid and unpaid breaks during their workday. The frequency and length of these breaks will be determined by the number of hours an employee works.

Meal breaks are required to be at least 30 minutes long, while rest breaks need to be at least 10 minutes. Although employers don’t need to pay out meal breaks, rest breaks must be paid out at the employee’s normal working rate. Breaks should be negotiated in good faith between the employee and employer.

Managing breaks can be interesting, so find out how to get it sorted in this handy Rest and Meal Breaks Q&A.

What about overtime?

In New Zealand, paying hourly employees a higher rate for overtime is not a legal requirement. However, many employers choose to pay their employees overtime anyway. All the details should be outlined in the employment agreement and agreed upon by the employee. Regardless, waged employees must be paid for all hours worked.

Approving Time Before Employees Get Paid

If your employees are clocking in and out with a rostering or payroll system, timesheet approval is a great feature to look out for. With timesheet approvals, recorded time can be approved by a manager or admin before employees get paid. By first approving time, managers can pick up any mistakes or make changes to prevent future leave payment mishaps for hourly employees.

Keeping up with the data

A good payroll system will help minimise the data load, but a great payroll system is specifically built to ensure compliance. Use reporting features to maintain accurate record-keeping so you can sleep easy.

What about FBAPS entitlements?

Annual leave rates differ slightly from DBAPS leave rates. If the relevant daily pay is known, this should always be paid before the average daily pay. You can read more about how to pay your employees correctly when taking DBAPS leave here.

For now, let’s see what your hourly employees are entitled to.

Family violence leave

Hourly employees are also entitled to 10 days of family violence leave. To qualify for this, employees must have worked for six months continuously with the same employer, or for an average of 10 hours per week and at least one hour every week or 40 hours every month over six months.

Bereavement leave

The minimum entitlement for bereavement leave that meets certain circumstances is three days. All employees, including hourly workers, can use bereavement leave if they meet the same criteria outlined for Domestic violence leave.

Alternative holidays

Also known as days in lieu, alternative holidays are days owed to an employee in return for that employee working on a public holiday if it’s an Otherwise Working Day. A full day off is due to any employee who works on that day, regardless of how many hours they work.

On-call employees are also entitled to an alternative day if they are called in, or if they did not get a proper day off because of work commitments (e.g. answering emails) or any imposed restrictions on what they can do while on call.

Employees do not get an alternative holiday if they would not usually work on that day, if they normally only work on public holidays, or if being on-call caused no interruption to their day.

Public holidays

Hourly workers are still paid for a Public Holiday they didn’t work if it’s an Otherwise Working Day for them. If the hourly employee did work on a public holiday, they are owed Time and a Half, plus an alternative day if the day is determined to be an OWD. Learn more about paying hourly employees for public holidays here.

Sick leave

Every type of employee in New Zealand is entitled to 10 days of paid sick leave if they meet the same requirements listed for Domestic Violence and Bereavement leave. Employees are owed sick leave only if it is an OWD for them. If they have no sick leave available, you might agree to let them take sick leave in advance of their entitlement, or take unpaid leave.

Top Tips and Reminders for Managing Hourly Employees

Use recorded time and review periods to determine Otherwise Working Days

Use recorded time and review periods to work out the employee’s work pattern for annual leave

Employees are allowed to say ‘no’ to work if there is no valid availability clause in their agreement. Read more in MBIE’s Hours of Work article here

Good reporting will save you when any errors pop up

Hourly employees must be paid what they would’ve earned if a shift is cancelled at the start of their shift, or once they have already started

Holiday Pay As You Go isn’t always the best default option for hourly employees

Hourly employees are still entitled to the appropriate DBAPS leave

Paying hourly employees can get interesting, but now that you have all this new knowledge in your payroll toolkit, it doesn’t have to be so difficult. As described in this guide, waged employees are entitled to most of the same leave payments salaried employees receive. The key is to nail your time tracking for employees who work variable hours, and the rest will follow.

Plus, with a compliant and intuitive payroll system, all the heavy lifting is done for you. Try PayHero for free today.