What are employee allowances?

Allowances (definition)

Employees may be given an allowance by their employer to cover employment-related expenses such as accommodation, clothing, meals and other travel costs. These allowances are paid on top of the employee's regular salary/wages.

Every allowance can be taxed slightly differently according to the circumstances. Read more on IRD about how to tax each type of allowance.

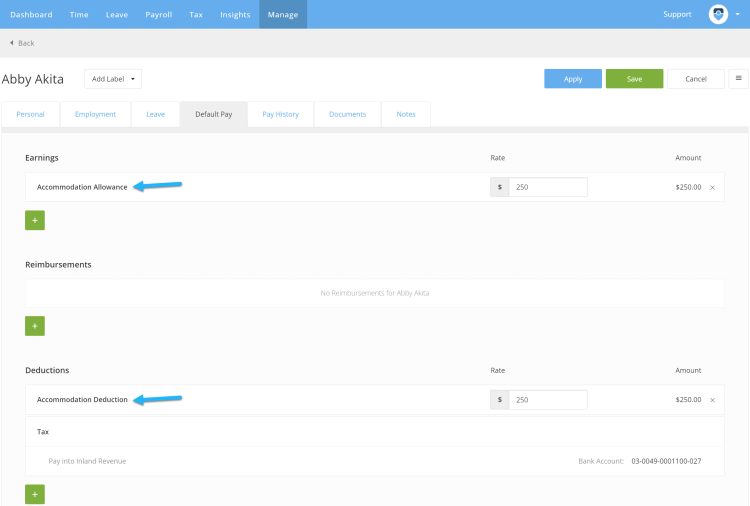

These tax quirks will need to be taken into account when processing payroll. In PayHero, you can add the appropriate Pay Items into the employee’s default pay. The Accomodation Allowance Pay Item is automatically set up as a Gross Earnings tax type. In contrast, Reimbursements are treated as a non-taxable allowance.

Related Definitions

Related Resources

Find a payroll expert or get started today

14 Days Free · First Pay Walkthrough · No Credit Card Required