Payroll & Finance

Cashing out Annual Leave

June 23, 2020

Since the Holidays Act 2003 came into force in April 2004, NZ employees have been entitled to a minimum of 4 weeks annual leave after 12 months of continuous employment, and 4 weeks for every 12 months thereafter.

The purpose of annual leave is to provide employees with the opportunity for paid time off work for rest and recreation.

It is very important to remember this last statement, as it is a foundational/founding principle of the Act. This law made it unlawful to adopt “use-it-or-lose-it” leave policies, it restricts cash out options and allows employees to build up unlimited annual leave entitlements during employment.

The law wants people to take a break, which is a good thing! Rested people are safer, happier and more productive.

This guide is designed to make it clear what employers can and cannot do regarding leave cash outs.

Cashing out annual leave is only allowed in some very specific situations:

When an employee leaves their employment.

The employer must pay all owed annual leave and alternative holidays (not sick leave or bereavement leave). Any deductions from this annual leave pay out can only be made if other important parts of employment law are followed.

If the employee is genuinely casual or on a fixed-term agreement less than 12 months.

These employees receive pay-as-you-go holiday payment on top of their wage or salary at a rate of 8%, paid with their wages. Permanent part-time, permanent full-time or fixed-term longer than 12 months must not be paid annual leave in this way.

Up to 1 week per year by agreement, in accordance with Section 28 of the Holidays Act.

See below.

Outside these situations, you cannot cash out a permanent employees’ annual leave accrual during their employment, even if they ask for it.

Holidays Act 2003 Section 28A – 28E

The Legal Cash Out of 1 Week Annual Leave

In accordance with Section 28A of the Holidays Act 2003, an employee can request, in writing, to have up to 1 week of their annual leave, per entitlement year, paid out to them.

Some very important points to note about this:

The request and subsequent approval must be in writing.

The Employer does not have to agree to the request but must consider it in good faith.

The Employer cannot force an employee to cash out 1 week, nor make this a term of employment.

The entitlement is up to 1 week; so, it might be 1 day, and it can be over multiple requests provided the total doesn’t exceed 1 week each entitlement year.

The pay-out can only occur from entitled leave, which is the leave that is available after 12 months of continuous employment and each subsequent 12 months – no cash out in the first year of employment.

The pay-out cannot be back-dated. For example; if an employee has not made a request for 4 years, this does not mean they can claim 4 individual weeks from those previous years.

Check out FlexiTime’s latest blog on the Holidays Act here.

Q&A

Despite the clarity of the Holidays Act regarding cashing out of leave, we have been surprised to find that some employers still pay out leave to their employees over-and-above the 1 week allowed by law.

In our experience, this is not because the employers are dodgy at all – leave is most often paid out following a direct request from an employee who needs the money. The employer believes they’re helping their staff and many employees feel that they should be allowed to get access to this money as it’s their accrual.

The blanket response to this is that you cannot cash out more than 1 week of leave per year for permanent employees.

Here are some questions we are frequently asked:

Q. What happens when an employee needs the money for hardship or general life expenses and pleads with me? I know they need to cover bills at home, can I pay out a few extra days to help them out?

A. Nope. Sorry, the Holidays Act does not allow for hardship like this.

Speaking from experience, these conversations can be very difficult and upsetting, but there really isn’t any wiggle room on this.

You could consider some other form of financial help. Paying the money as a wage advance or some form of loan. This may be accompanied with a written agreement that the employee must pay the money back from wage deductions or have the money deducted from their final pay if they leave employment (which may include owed annual leave). We recommend getting some advice before taking this option as there are a few fish-hooks to be mindful of.

Q. What about part-timers? They often don’t take much leave because they only work one day per-week and they ask me for the cash.

A. No, unfortunately once again the Holidays Act doesn’t allow for this either. Part timers are also entitled to 4 weeks holiday and only allowed to have 1 week per year paid out.

Q. OK, so my part-timer and I have agreed that she’ll take her “holiday” next week on days she normally doesn’t work. I’ll pay the holiday in her next pay, along with the worked shift. All good?

A. Creative! And we are aware of some employers and employees agreeing to do this, both parties agree to it and enjoy it. But it’s also in breach of the Act, so we do not advise doing this – if your relationship turned sour, the employee could claim that they never took their leave and would get paid it again (double dipping).

Q. I have heaps of students working for me, they will regularly ask for the cash to buy a new laptop for Uni, or food or concert tickets. They value this cash, it’s like forced savings for them and they see it as their money. Plus, it’s good for me because I can manage my leave liability.

A. We understand your situation, but no, they can’t request this additional cash out. Yes, it is their money, but it is money in the form of a holiday accrual. It is there for them to take a paid break for rest and recreation, not as savings for life expenses.

Q. Can they quit on Friday and re-start on Monday, then get all their leave?

A. Sadly, not this one either. They would need to be out of work for the length of time the leave covers, plus their contractual notice period. Remember too that the employee is entitled to be paid for public holidays that fall after their employment ends within the notice and leave period. This means if they return to work too soon you could end up paying twice for public holidays!

This approach is also administratively heavy, as you need to terminate them in your payroll, make all the final payments, then reinstate them and create another employment agreement.

Not to mention you’re in breach of the Act!

Q. OK fine, so what are the consequences if I just go ahead and ‘cash up’ the employee’s annual leave above and beyond what legislation allows?

A. If you’re caught, you will be required to reinstate the annual leave to employee that is equivalent to the amount you cashed out and the employee can keep the cash out that was previously paid (double dipping). In addition, you may be required to pay a penalty.

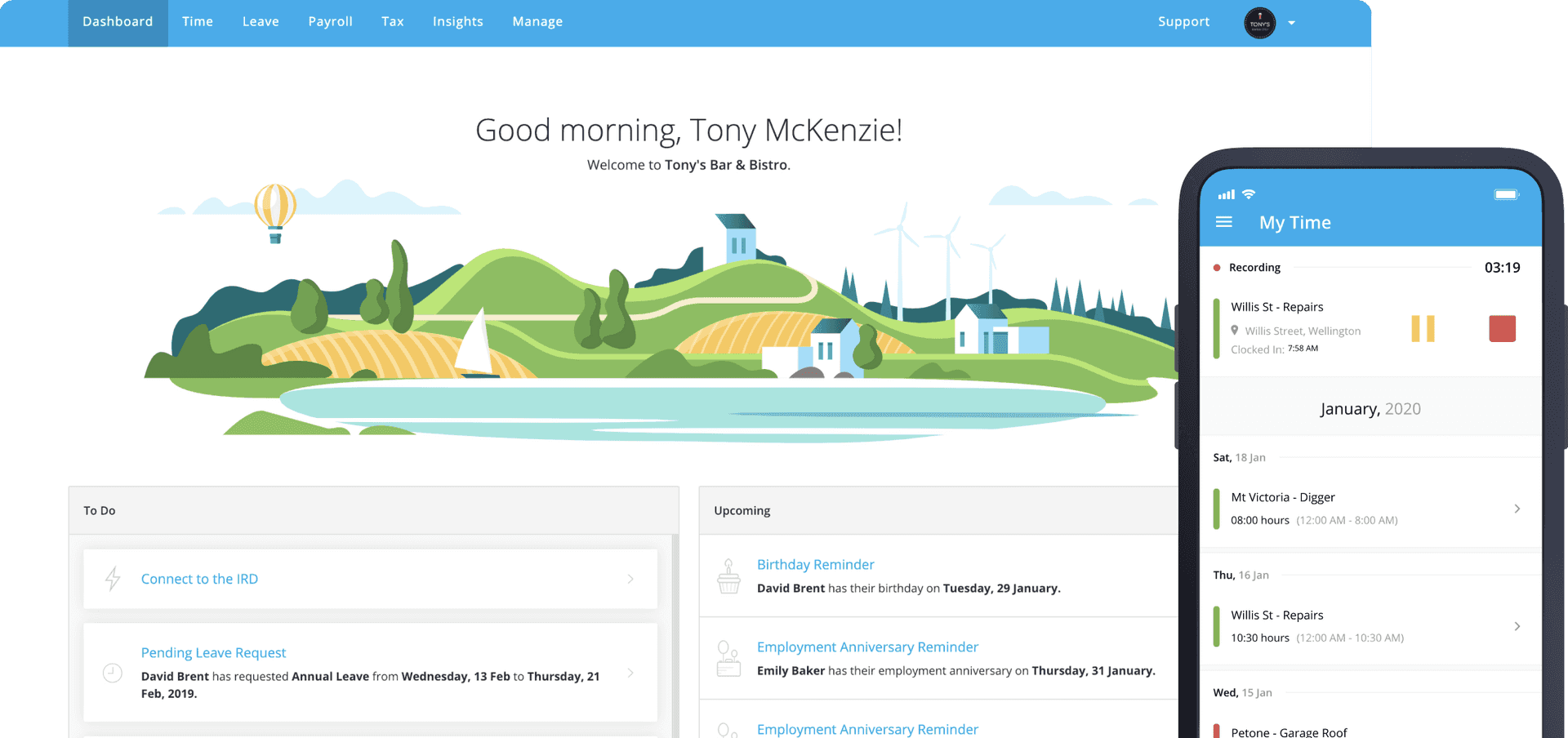

If in doubt, call MyHR on 0800 MYHR NZ (69 47 69) or email FlexiTime Support at support@flexitime.co.nz. The Holidays Act 2003 is a challenge and many employers get into trouble.

About MyHR

Jason launched MyHR in 2013 with a vision to change the face of HR. MyHR is intuitive, easy-to-use, online HR software, coupled with a team of dedicated HR professionals, providing customised support to over 600 organisations who employ 10,000 people in NZ, Australia, UK and Singapore.