Payroll & Finance

Final Pay Factsheet: What Employers Need to Know

March 24, 2022

You might be aware that an employee’s Final Pay (also known as termination pay) is processed a little differently to a normal pay. But exactly how is it different? There are a few facts to know about Final Pays to ensure your employees don’t come knocking on your door after hitting send on their last paycheck.

Here’s everything you need to include in a Final Pay

For hourly employees, all hours worked between their most recent pay and final shift

For salaried employees, their regular fixed wage until their final day of employment

Annual leave and alternative holidays that are still owing

Payment for public holidays that would fall due if the employee were to take any outstanding annual leave

Any lump sum or other payments owed, including those written in an employee agreement or negotiated leaving package. For example, a redundancy payment.

More on these inclusions later…

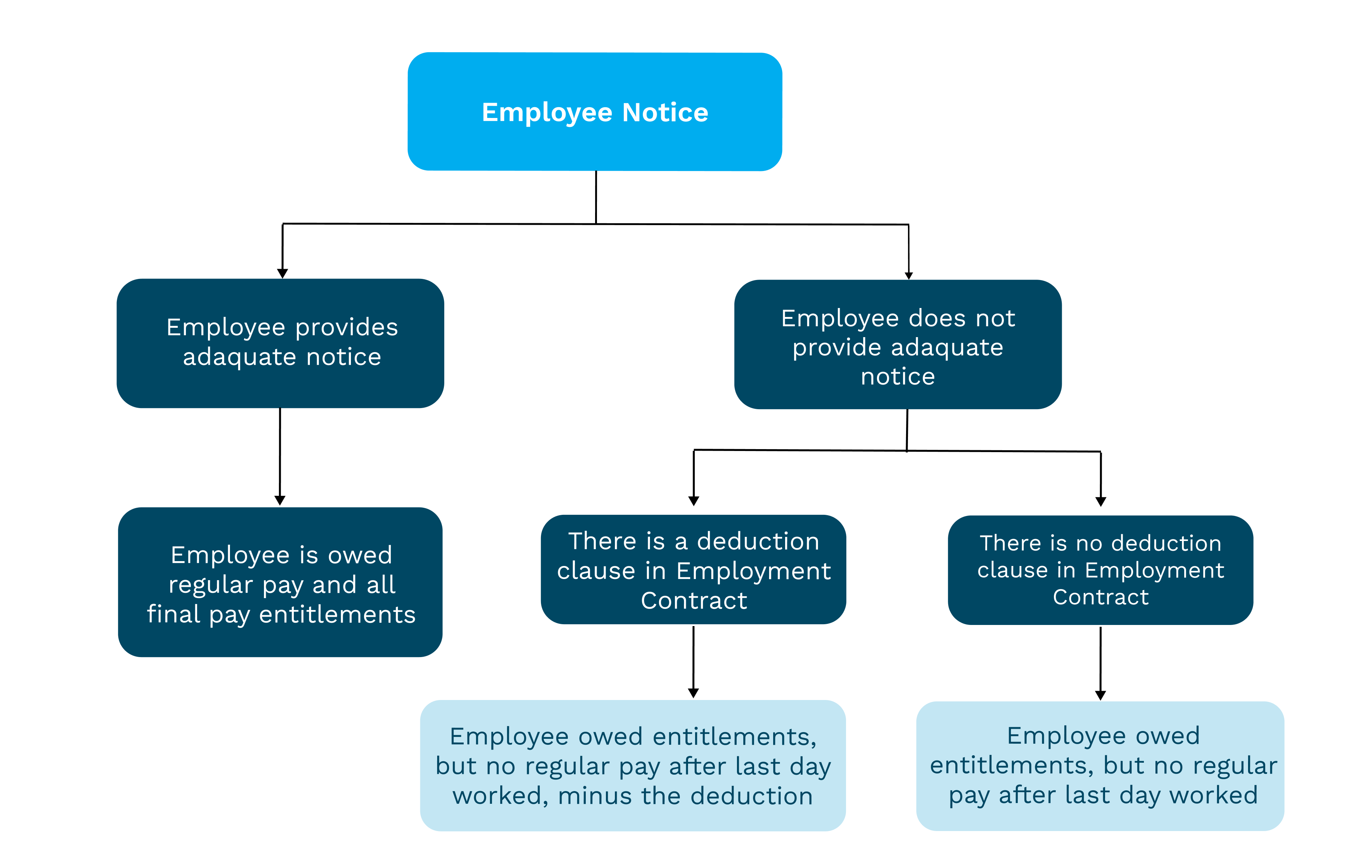

Take notice of an employee’s notice

If an employee doesn’t give the required notice, they’re not owed any regular pay after the last day they actually work. However, they’re still owed the other entitlements listed above. In some cases though, if an employee does not give adequate notice, a deduction clause in the employment contract may allow the employer to deduct a sum from the employee’s final pay to cover the cost of securing a replacement. The deduction must be lawful and based on actual loss. If there are concerns about how to handle this, seek legal advice.

If that all sounds like a lot, this chart might help:

If the employee has given the required notice and the employer asks them to stop working before the date listed, the employee is entitled to payment for the hours they would’ve normally worked until the end of their notice period.

Of course, the employee and employer can reach a mutual agreement depending on their circumstances. For example, if an employee doesn’t want to work the full notice period, they could negotiate with the employer to waive the pay for the period they were supposed to work.

Don’t Forget Annual Leave (and Public Holidays) in the Final Pay

For entitled employees, any annual leave still due is paid out at the highest of their Ordinary or Average pay rate.

If annual leave has been taken in advance, this is deducted from the pay.

Employees also receive 8% of their gross earnings since their last annual leave anniversary date. This will include 8% of any annual leave due that is being paid out.

But, do employees get paid for public holidays after their final work day?

If an employee has annual leave owing, this is considered to occur after their final date worked. If a public holiday occurs over this period the employee is entitled to payment for this holiday. Read more about paying public holidays here.

Here’s an example, if Sarah has her last day of work on the 23rd December, but she still has two weeks of annual leave owing, then she will be paid for all public holidays during this period ending on 6th January. This would include Christmas Day, Boxing Day, New Years Day and the Day After New Years Day.

Note that the annual leave must have been due as at the employee’s last anniversary. Any annual leave accrued since then does not extend out the public holiday date.

For employees who have been paid 8% holiday pay as you go, their final pay won’t include any annual leave or public holidays, but they are still eligible for alternative days. Also, some employees may have switched over to HPAYG from a contract where leave was due, so it’s important to check they aren’t owed anything from previous work arrangements.

Calculating Sick Leave

Legally, sick leave doesn’t need to be paid out like annual leave when an employee finishes their employment. However, some companies may have a sick leave pay out clause in their employee agreement.

Making Sense of the Final Tax

Any leave payments in a final pay are taxed as an Extra Pay (lump sum payment), so the amount of tax owed might look a little different to an average pay.

If your employee is concerned that the tax seems too high in comparison to their regular pay, check out the lump sum payment section in this Bonuses article and you can explain how the above calculation is designed to reduce their tax.

Some special payment types have unique exclusions. Retirement and redundancy allowances are exempt from the ACC Earners’ Levy resulting in a slightly lower tax rate. Redundancy payments do not accrue 8% holiday pay. Retirement payments are not included in KiwiSaver calculations.

What to do when an Employee Owes your Company

Occasionally, an employee may owe the company money due to annual leave taken in advance, the employer has covered an employee’s expense or the employee was overpaid.

Money owed to the business by an employee can only be deducted from their final pay if agreed in writing with the employee. However special rules apply in this circumstance, so if you're unsure it’s best to seek legal advice.

How to Easily Process a Final Pay with PayHero

Include the employee in their Pay Cycle as normal (it can be in their regular pay cycle, even if they finish part-way through the pay cycle)

Either select Finish Employment in the employee’s settings prior to running the pay or select Set as Final Pay in the options menu from within the pay. PayHero will add what’s needed onto the Final Pay.

When the pay is sent, the employee's finish date will be included in your IRD filing for this pay period.

Read more here about processing Final Pays in PayHero.

Employment New Zealand has a handy flowchart to help clarify what to include in a Final Pay. If you’re feeling overwhelmed by the process, a great payroll system will make a world of difference. Check out PayHero with a free 14-day trial. Happy Final Pay days!