How is holiday pay calculated?

Holiday Pay (definition)

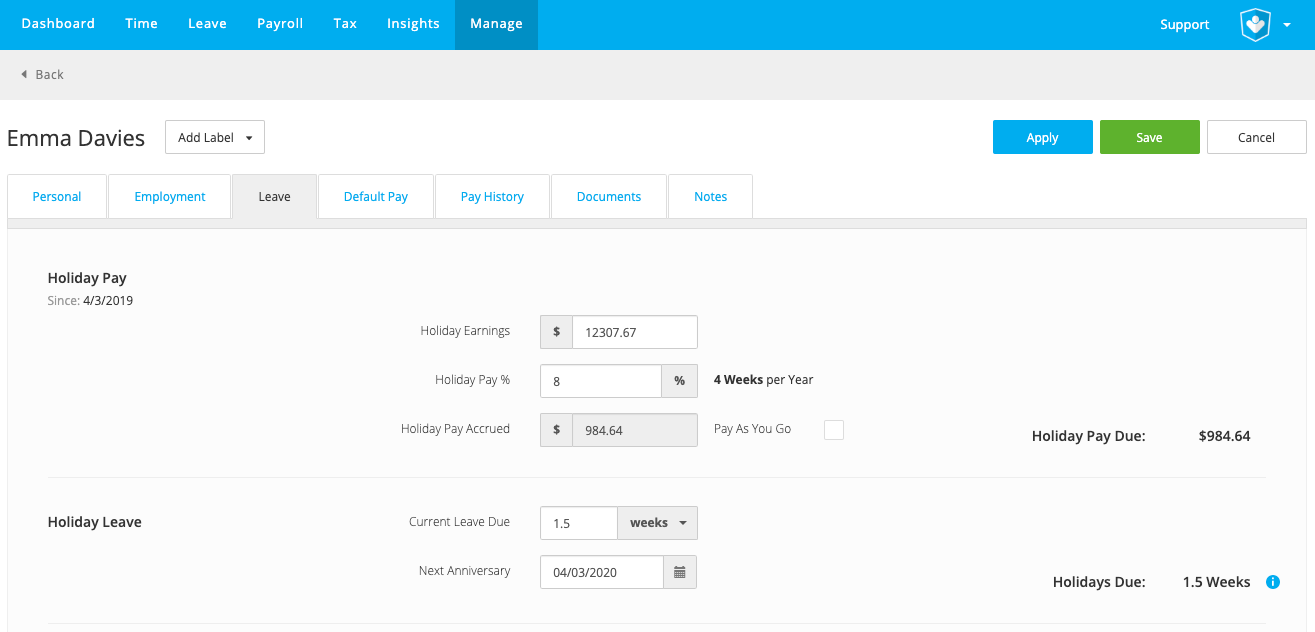

At any particular time an employee is owed two separate amounts - Holiday Pay Due and Current Leave Due. If the employee finishes employment after crossing their first or any subsequent anniversaries, they will be paid out the Holiday Pay Due that has accrued since the last anniversary, plus any Current Leave Due remaining from previous years.

Holiday Pay Accrual is worth 8% of these earnings since their Employment Start Date or Holiday Pay Anniversary date. As shown in the image below, if an employee were to finish their employment they would be owed the $984.64 in Holiday Pay (8% of their Holiday Earnings) plus 1.5 weeks of current leave due.

After if an employee still has leave due on their final day of employment, they are owed any public holidays that fall within the following period. For example, if the employee above finishes a week before Queen’s Birthday, and it is considered an Otherwise Working day for them, they are entitled to payment for the public holiday as they have 1.5 weeks of leave due.

If an employee is paid Holiday Pay As You Go, they will be paid 8% of Holiday Pay each pay cycle, instead of the current leave or holiday pay due.

Every payroll software has its own quirks when it comes to calculating Holiday Pay. PayHero is determined to say compliant with the Holidays Act and ensure employees are paid right.

Related Definitions

Related Resources

Find a payroll expert or get started today

14 Days Free · First Pay Walkthrough · No Credit Card Required