What is an otherwise working day?

Otherwise Working Day (definition)

The Otherwise Working Day calculation is vital to determine what an employee should be paid for a public holiday. A day is considered an OWD for an employee if it is a day they would normally work. In many cases, this is easy to determine, but for some employees with variable working patterns, OWDs aren't so clear-cut.

There are several factors to consider when determining an OWD for an employee:

The employment agreement.

The employee's Work Patterns (Our automated Public Holidays and OWDs that are set up in PayHero will look at using these to determine an employee's OWD).

Whether the employee only works for the employer when work is available.

If there are reasonable expectations between the employee and the employer that the employee would work that day.

However, a rule of thumb recommended in the Holidays Act Review is if an employee has worked 50% or more of the corresponding days in the previous four or 13 weeks then it is an OWD for them.

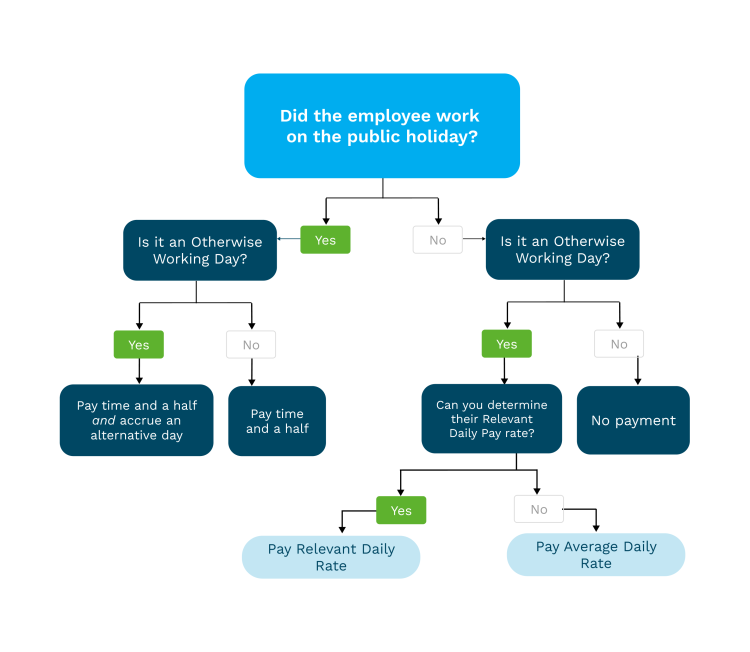

Once you know what is and isn’t a working day for an employee, you can determine what they should be paid. We’ve distilled a handy little chart for you to refer to that we hope will make payroll much easier after the next public holiday.

Related Definitions

Related Resources

Find a payroll expert or get started today

14 Days Free · First Pay Walkthrough · No Credit Card Required